The semi-conductor shortage and its resultant supply-side constraints, high acquisition price, as well as fuel costs and unexpected floods, have played spoilsport for India’s automobile retails for November 2021, despite Diwali as well as the marriage season falling in the same month. Dealers have expressed concern that unless rural India starts showing signs of strength, overall retails will continue to remain weak. Added to the woes was the spread of new Covid variant Omicron, which they fear would once again halt normalcy from returning, as educational institutes and offices defer opening plans.

Passenger vehicles (PVs) continue to face the brunt of the chip shortage. While the new launches had been keeping customer interest high, it was only the lack of supply which was not allowing sales to conclude. The extended waiting period is now starting to make customers jittery and this may lead to loss of interest in vehicle buying, according to dealers.

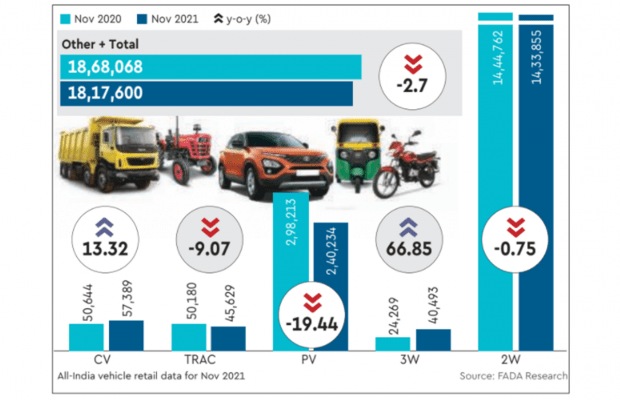

According to vehicle retail sales data for November 2021 released by the Federation of Automobile Dealers Associations (Fada), on a y-o-y basis, total vehicle retails decreased 2.70% and when compared with November 2019 , a regular pre-Covid month, overall retails dropped 20%. Two wheelers (2Ws), passenger vehicles and tractors fell by 1%, 19% and 9%, respectively, underlining the fact that 2W sales were not able to show momentum despite Diwali and the marriage season. However, three-wheelers and commercial vehicles were up by 67% and 13%.

The fall in retail sales numbers was along expected lines, as the chip shortage continues to hit original equipment manufacturers (OEMs), which resulted in production cuts by many players, impacting despatches to dealerships. Maruti Suzuki had announced that the company is expecting an adverse impact on vehicle production in the month of December 2021 in both Haryana and its contract manufacturing company, Suzuki Motor Gujarat (SMG) in Gujarat. It has estimated that total vehicle production volume across both locations could be around 80% to 85% of normal production. While the two-wheeler segment saw almost on-par sales compared to last year. which itself was a bad year, the overall sentiment remained low as the marriage season also didn’t help in revival except in one or two states.

Apart from this, crop loss due to incessant rains and flood in southern states, high acquisition price as well as fuel costs kept the customers away. Further, there were no signs of increase in inquiry levels, which was a bigger cause of concern.

Fada president Vinkesh Gulati said:“Semiconductor crisis continues to haunt PV sales, despite huge bookings, the dealers were unable to satisfy customers due to supply issues resulting in long waiting periods.The commercial vehicles lead by M&HCV continues to show growth over last year (on a low base) but has a long way to go when compared to pre-Covid times.”

Giving some reprieve to the dealers, the commercial vehicle segment saw traction with the M&HCV segment leading the pack. This was aided by a low base, resulting in double-digit growth; however, the bus segment was still witnessing a dry run as educational institutes continue to remain closed. With diesel prices at record highs, supply of CNG vehicles were not able to meet the demand. Tight liquidity and unavailability of finance for customers who availed moratorium were also acting as sales barrier.

The analysts’ commentary has also reflected the continued slowdown in the retail sales. Arun Agarwal, deputy VP, fundamental research, Kotak Securities, said: “Auto sales in November 2021 were impacted by chip shortage in passenger vehicles, light commercial vehicles, and the domestic premium motorcycle segment. The passenger vehicle segment saw healthy inquiries and booking in the festive season and thereby volumes in this segment are expected to improve once the chip shortage situation gets resolved. In the commercial vehicle space, the medium and heavy commercial vehicle segment continued their gradual recovery supported by improved fleet utilisation levels.”

On the near-term outlook, the dealers’ body said the new Omicron variant of Covid has once again gripped the entire nation in fear and this will further impact the overall vehicle demand. Price rise due to high input costs and high fuel costs are continuing to add customers woes.

Fada said it is hopeful that the chip shortage will ease in times to come and reduce waiting periods of vehicles, helping to increase sales. Dealers remain extremely cautious and hope that India does not see a third wave with the new Covid variant.