The Reserve Bank of India (RBI) has decided to focus more on growth to support the economic recovery than keeping inflation in check, said economists and market experts. The RBI maintained CPI inflation forecast of 5.3 per cent for FY22 and predicted FY23 CPI inflation at 4.5 per cent. RBI forecasted Q1 FY23 CPI at 4.9 per cent, Q2 at 5 percent, Q3 at 4 per cent and Q4 at 4.2 per cent.

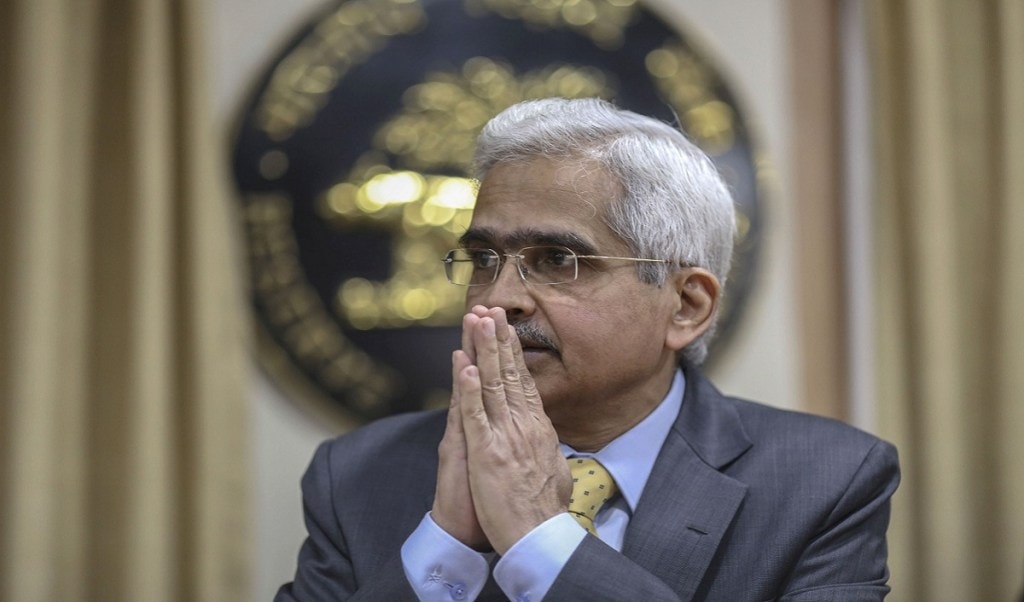

“We have made an effort to limit disruption to economic activity. While CPI edged higher, it is along expected lines. Core inflation remains elevated and headline inflation is expected to peak in Q4 FY22, and turn moderate in H2 GY23. Continued policy support is warranted for durable, broad-based recovery, said RBI Governor Shaktikanta Das.

RBI more focused on growth versus inflation

RBI said the Consumer Price Index is expected to soften in the upcoming fiscal to 4.5 per cent in comparison to CPI projections of 5.3 per cent for the current year even as the crude oil prices pose risk. “The RBI remained more concerned on growth versus inflation and thereby maintained all the policy rate unchanged. The monetary policy stance also remains accommodative. We think that the RBI had at least the space to do a symbolic 15 bps reverse repo hike so as to signal rate normalisation, commitment to be at the top of the inflationary situation and also keep the Indian monetary policy in alignment with the global trend,” said Sujan Hajra from Anand Rathi Shares & Stock Brokers.

Suvodeep Rakshit, Senior Economist, Kotak Institutional Equities, said, “Today’s policy risks sharper adjustments if inflation risks materialise. Inflation risks, especially from fuel prices, remain a concern and can materialize relatively soon. Compared to RBI estimates, we estimate FY2023 GDP growth 30 bps higher at 8.1% and FY2023 CPI inflation 50 bps higher at 5 per cent. We believe it would be opportune to increase reverse repo rate hike by 40 bps in the April policy.”

However, Prasenjit K Basu, Chief Economist, ICICI Securities, said, “Given global headwinds and the prospect of a gradual moderation of India’s CPI inflation, it is eminently sensible to persist with the accommodative stance. A key reason to keep the policy interest rate at historic lows longer is to spur a more durable rebound in private consumption. India did not massively boost monetary growth during the worst phase of the pandemic (as the US Fed, ECB and BoE did), so there is less need for the RBI to roll back monetary accommodation this year.”

How will India fare post decoupling from US monetary policy?

RBI’s monetary policy was expected to follow global cues and increase interest rates, which did not happen today. “Policy rates remaining unchanged indicates that RBI is more focused on domestic macro variables rather than tracking global central bank actions. While the US Fed has clearly indicated multiple rate hikes going forward to combat rising inflation, the RBI seems far more calibrated in approach given its own projection of domestic CPI peaking in Q4FY22 and moderating in FY23,” said Nitin Shanbhag, Executive Group Vice President – Investment Products, Motilal Oswal Private Wealth.

“For now, the RBI has decoupled itself with the monetary policy momentum in the rest of the world, where higher inflation prints are leading to central banks of the developed economies to tighten rates. We believe that RBI may be able to hold back repo rate increases for longer and may not have any compulsion to follow global central banks unless their actions have any severe implication on the USD/INR rates. We foresee 2 repo rate increases in FY23 but predicting a timeline is difficult at this point,” said Indranil Pan, Chief Economist, Yes Bank.