Microcap mutual funds are one of the interesting categories in the Indian market, especially considering the stellar rallies in small and micro-sized companies in the past few years. But before jumping in based on hype, it is vital to understand what microcap funds are, how they work, the risks they carry, and whether they are suitable for your investment profile.

In this editorial, we break down everything you need to know to decide whether you should invest in microcap mutual funds.

What are microcap stocks?

SEBI defines micro-cap companies as those that rank below 500 in terms of market capitalization. These companies are usually small, high-growth potential firms that operate in niche segments. As they’re small and not well known by institutional investors, their stock prices may rise sharply if the company performs well.

Yet, lack of stability makes them extremely vulnerable to market downturns, liquidity challenges, and business failures.

Therefore, microcap stocks are considered one of the riskier classes within equities. Historically, in favourable economic cycles, microcaps tend to significantly outperform large and mid-caps. Fund managers with strong stock-picking ability may generate exceptionally high returns by spotting emerging leaders early.

This makes microcap mutual funds or schemes holding higher allocation to microcap stocks appealing for investors with a high-risk appetite and a long investment horizon.

But this high-return potential comes with considerable risks. Microcap mutual funds are prone to volatility triggered by sentiment-driven market flows. When markets become euphoric, microcaps rise disproportionately. However, when fear sets in, these stocks fall much faster and deeper than blue-chip companies.

This volatility plays to the SIP investor’s benefit as it could lead to rupee cost averaging.

However, for a lump-sum investor, bad timing could lead to long periods before a recovery. It’s very important to understand this characteristic of microcap investing before you consider this segment.

In the Indian mutual fund landscape, pure microcap exposure is still at a very nascent stage.

As of now, Motilal Oswal Nifty Microcap 250 Index Fund is the only mutual fund directly tracking the microcap benchmark, making it the first passive scheme in India to offer investors a structured and diversified gateway into the microcap universe.

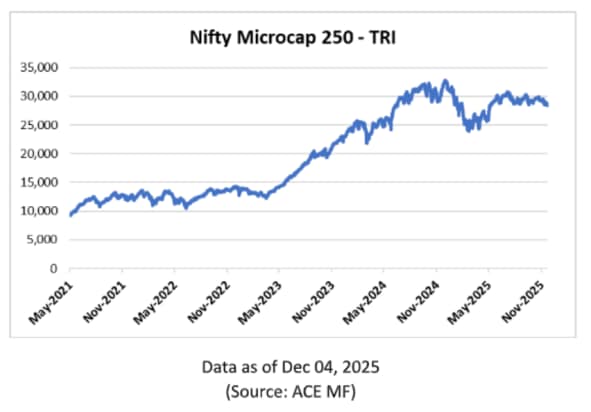

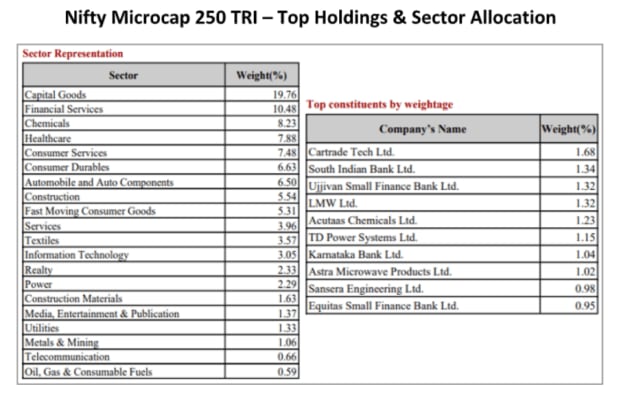

(Source: NSE – Nifty Microcap 250 TRI Factsheet)

This fund, launched in July 2023, tracks the Nifty Microcap 250 Index and provides investors with exposure to the smallest 250 companies in a rule-based, low-cost manner.

This is an index fund and, as such, does not have the flexibility to avoid overvalued or fundamentally weak companies, especially challenging in the microcap segment where risks are high. Apart from that, the active microcap space is only beginning to take shape. A number of actively managed small-cap funds already hold a meaningful portion of microcap stocks as part of their bottom-up stock picking strategies.

Bandhan Mutual Fund has filed to launch India’s first actively managed microcap fund in 2023. Although there is no update on an approval, this signals further development in this high-risk, high- return segment.

Other fund houses, too, have different levels of indirect exposure to microcaps through their existing schemes. The category is still evolving and investors could expect more choices in the microcap space in the future. However, they need to be prepared for high volatility and challenges specific to investing in very small companies.

Outlook of the Microcap Segment

The outlook for the microcap segment in India remains structurally positive but increasingly selective, driven by strong domestic growth, rising formalisation, and a continued shift toward indigenous manufacturing and innovation-led businesses.

With India aiming at a US$ 7-8 trillion economy by 2030, microcap companies, particularly those engaged in digital infrastructure, EV components, specialty chemicals, defence ancillaries, and niche manufacturing, would disproportionately benefit from major government initiatives such as Make in India 2.0, PLI expansions, the India Semiconductor Mission, and MSME credit reforms.

However, valuations remain elevated across a number of pockets in early 2025, on account of aggressive inflows, with SEBI pushing AMCs to have stronger liquidity frameworks and stress tests around small and micro-cap exposure.

With near-term volatility and corrections likely as markets digest high valuations and global macro softness, the medium to long-term trajectory of the microcap ecosystem remains constructive.

As these companies scale, formalise operations, and migrate into the small and mid-cap buckets, they may unlock significant value. This makes the microcap space a promising but high-risk satellite opportunity for investors with patience, discipline, and a long investment horizon.

What You Should Know

The bottom line is to understand from the outset that the judgment call regarding the suitability of microcap mutual funds starts with an honest assessment of your risk tolerance.

Microcap stocks are so volatile, even the best diversified microcap fund may see sharp movements during a market corrections. Ideal microcap exposure, either through the sole microcap index fund available in India or through

actively managed small-cap funds holding microcap stocks, should be aligned with long-term wealth creation objectives such as retirement, long-term asset building, or financial independence.

Microcaps do not suit short-term or medium-term goals because they are unpredictable and take a long time to recover.

In asset allocation terms, microcaps should only constitute a satellite portion of an equity portfolio. Limit your exposure to about 5–10%, depending on your overall risk profile.

The core of your investment strategy should be anchored in rather stable and diversified categories like large-cap, flexi-cap, or multi-cap funds. Microcap exposure is best used as an enhancer—not the foundation—of your long-term portfolio.

Understanding product design has become important since the Indian market currently offers only one microcap index fund, while actively managed microcap strategies are still in the pipeline stages.

A SIP might reduce timing risk and smoothen this sensitive segment’s impact on volatility. Investor choice could broaden as more fund houses contemplate launching microcap strategies, but so will the need to make well-informed decisions.

In conclusion, microcap mutual funds are not designed for every investor. Aggressive, long-term investors who are able to tolerate high volatility, remain patient during prolonged downturns, and invest with discipline rather than impulse are their primary customers.

For those who understand the risks, maintain proper allocation, and adopt a systematic approach, microcap funds offer participation in the high-growth potential of emerging and undiscovered companies in India.

A key takeaway is to approach microcap investing as a strategic, measured allocation rather than as a quick route to high returns.

Invest wisely.

Happy investing.

Table Note: Data as of December 04, 2025

The securities quoted are for illustration only and are not recommendatory

Past performance is not an indicator for future returns.

Returns are on rolling CAGR basis and in %. Direct Plan-Growth option.

Those depicted over 1-Yr are compounded annualised.

Risk ratios are calculated over a 3-year period assuming a risk-free rate of 6% p.a.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors.