Madhusudan Kela, one of the most widely followed and looked up to super investors of India, has been in our list of the Warren Buffetts of India for long now. Known for his expertise in small cap stocks, which mostly go on to become multibaggers, his followers track his moves very closely.

And two of his only picks from 2025 have given rise to a lot of questions in the minds of the investor community. A machine manufacturing company that is in the red again when it comes to profits and the other a financial solutions provider that is writing its own envy worthy turnaround story.

Let us dive into these two Kela picks to see if they deserve a spot in the Watchlist 2026.

#1 Windsor machines: The “deep value” bet that hasn’t paid off yet

Incorporated in 1963, Windsor Machines Ltd, a company with a current market cap of Rs 2,359 cr, is into the business of manufacturing of plastic processing machinery, which includes pipe extrusion, blown film extrusion and injection moulding machines.

Madhusudan Kela bought a 7.7% stake in the company as per the filings made for the quarter ending March 2025, worth Rs 240 cr. He currently still holds the same 7.7% stake, but the value of the holding has dropped to Rs 177 cr.

Let us look at the financials of the company to try and find the reason behind this big drop.

The sales of the company have grown at a compounded rate of just 5% from Rs 283 cr in FY20 to Rs 369 cr in FY25. And for H1FY26, the sales were Rs 250 cr.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) jumped from Rs 6 cr in FY20 to Rs 24 cr in FY25, logging a compound growth of 32%. And for H1FY26, the EBITDA of Rs 16.5 cr was already recorded.

The net profit of the company is an area of concern, as after showing some growth and coming out of losses by FY23, the company recorded losses in the next 2 years.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profits/Rs Cr | -8 | 11 | 2 | 5 | -8 | -3 |

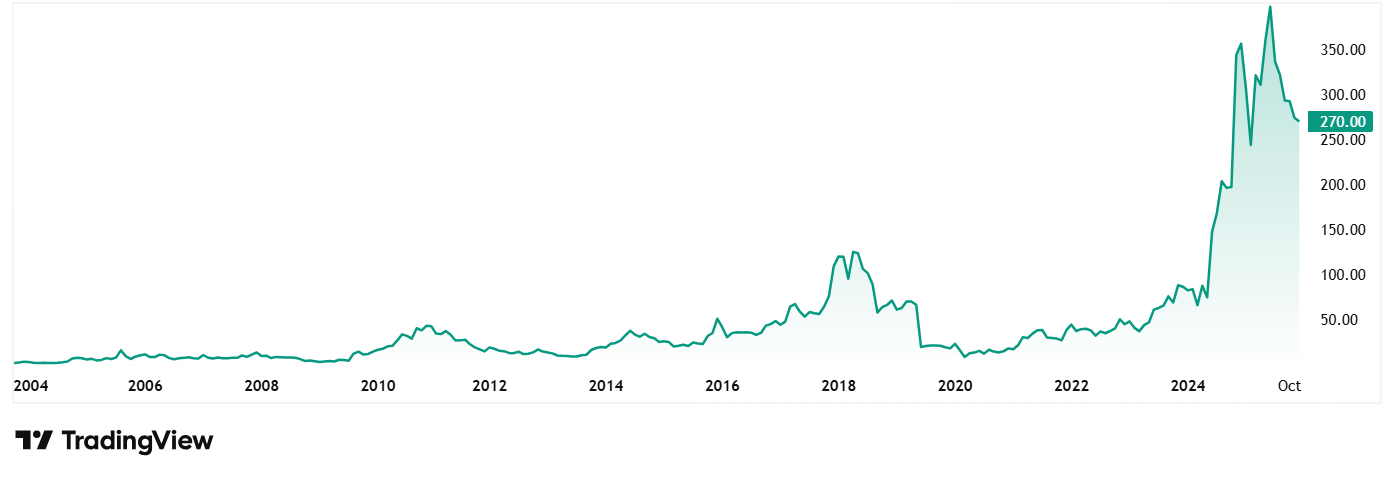

The share price of Windsor Machines Ltd was around Rs 20 in December 2020 and as on 8th December 2025 it was Rs 271, which is a jump of over 1,250% in the last 5 years. Rs 1 lac invested in the company a decade ago would have been Rs 13.5 lacs today.

At the current price of Rs 271, the stock is trading at a discount of almost 39% from its all-time high price of Rs 441.

The company’s share is trading at a PE of a huge 852x according to screener.in, while the industry median when compared to peers is a modest 34x. The 10-Year median PE for Windsor Machines is however 48x, and the industry median for the same period is due to the losses recorded, but the industry median is 29x.

The company has seen a change in promoter in the last year after it acquired Global CNC Private limited as wholly owned subsidiary in February 2025. In FY25, Plutus Investments and Holding Private Limited entered into a share purchase agreement with Castle Equipments Private Limited, the erstwhile promoter of the company in June 2024, pursuant to which, Plutus acquired from Castle 3,50,00,000 equity shares of Rs 100/- per equity shares and became a sole promoter of the Company w.e.f. September 10, 2024.

#2 SG Finserve: The 150-bagger that Kela just bought into

Incorporated as Moongipa Securities Ltd in 1994, the company was renamed to SG Finserv Ltd in September 2022. A company that provides financing solutions to channel partners (Dealers, Distributors, Retailers, Buyers, etc.) of Indian corporations at competitive rates to grow their business and that of their business partner.

With a market cap of Rs 2,164 cr, the company operates as a non-banking finance company with a specialised focus on supply chain financing solutions for Indian conglomerates down to the lowest tier. Through a seamless tech platform solution, it focuses in offering finance solutions to dealers, distributors, vendors, retailers, logistics providers, etc.

Madhusudan Kela bought a stake of 1.7% worth Rs 41 cr, as per the exchange filings for the quarter ending March 2025. Currently, he continues to hold the same 1.7% stake, the holding value of which has dropped to 37 cr.

Looking at the financials, the company’s revenue logged a compounded growth of over 250% from making no revenue in FY20 to Rs 171 in FY25. And for H1FY26, revenue of Rs 143 cr have been recorded already.

In case of the financing profits, the company recorded losses of Rs 1 cr in FY20 and staged a turnaround by FY2025 as it logged a profit of Rs 111 cr. For H1FY26, the company has recorded financing profits of Rs 73 cr.

Looking at net profits, the company made a loss of Rs 1 cr in FY20 and for FY25 the company logged a net profit of Rs 81 cr.

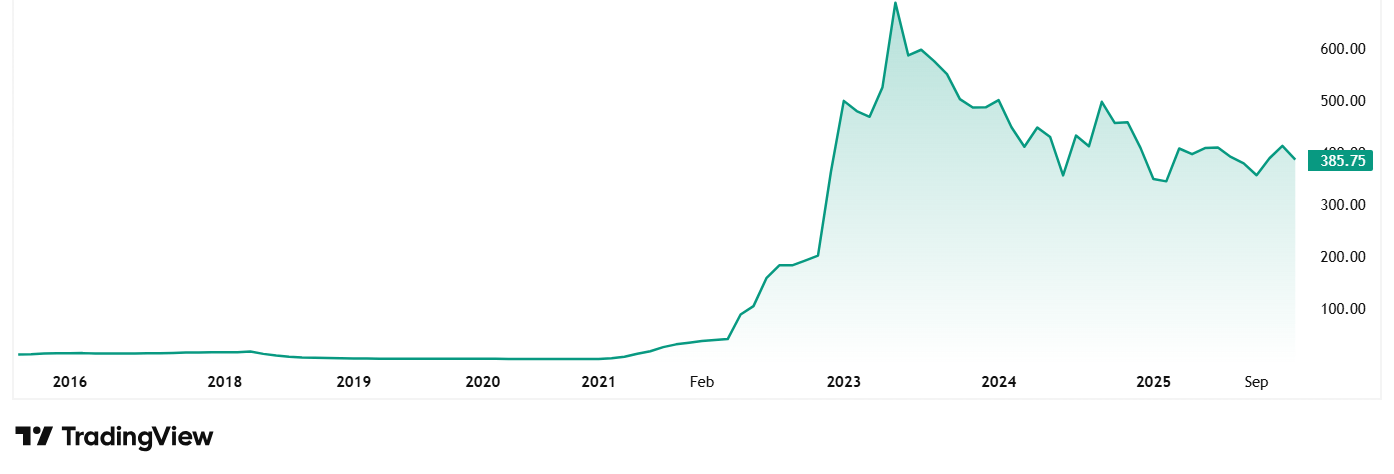

The share price of SG Finserv Ltd was around Rs 2.5 in December 2020 and as on 8th December 2025, it was Rs 387, which is a jump of over 15,300% in 5 years. Rs 1 lac invested in the stock 5 years ago would have been close to Rs 1.55 cr today.

The company’s share is trading at a PE of a modest 21x which is same as the current industry median. The 10-year median PE for SG Finserv however is 29x, while the industry median for the same period is a 20x.

According to the October 2025 investor presentation, the company has defined its ‘Blueprint for 2027’ which says that the company has established partnerships with marquee corporates, including the TATA Group, AMNS India, Vedanta, Ashok Leyland, JSW-MG Motors, APL Apollo, Adani Group, Jindal Steel, Kajaria Ceramics, Bajaj Electricals, and Oppo, all of which are market leaders in their respective fields.

MOUs with anchors aggregating to Rs 6,550 cr (up by Rs 1,050 cr in H1FY26) already in place, providing a blueprint to achieve the target loan book for FY27. The company also says that it will continue to focus on penetrating existing large anchors and target established anchors for incremental business.

Good cop, bad cop?

What we dug into today are two stocks that ace investor Madhusudan Kela bought in 2025 and are currently showing what we can call opposite trajectories. While the holding value for Kela in both stocks has seen a drop since the time he bought it, both stocks have a different story to tell.

Windsor Machines although showing signs of revival in the last couple of quarters, has been struggling net profits in the last few years. On the other hand, SG Finserv has written its own turnaround story and turned investors 1 lac to Rs 1.55 cr in just 5 years, backed by solid profit growth and other core financial metrics.

The question that remains is that, do both these stocks have in them to make it to the big league in 2026? One thing we must remember is that regardless of how both stocks look in terms of performance, Kela has still stuck with them, which means he probably sees something that an average investor does not. So, a clever idea would be to add these stocks to a watchlist and watch them closely.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article. The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.