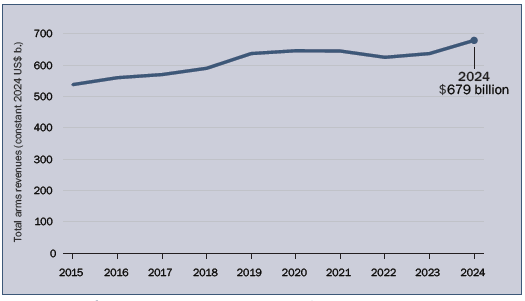

The world today is experiencing significant turbulence, leading to increased defence spending worldwide. As per the latest report by Stockholm International Peace Research Institute (SIPRI), the total arms revenues of the world’s largest arms-producing and military services companies, basically the top 100, reached $679 billion in 2024– the highest level ever recorded by SIPRI.

Total Arms Revenue

This implies a 5.9% year-on-year growth in real terms, and a 26% rise over the decade spanning 2015-24. This overall increase was primarily driven by rising arms revenues for companies based in Europe and the United States, as governments globally ramped up arms procurement amid rising geopolitical tensions.

Arms Revenue of Indian Companies Increased by 8.2%

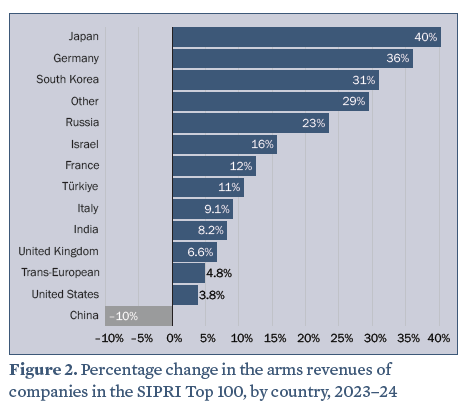

In fact, more than 77 companies from the Top 100 reported increased arms revenues in 2024. And in India, the aggregate arms revenue rose by 8.2% to $7.5 billion in 2024. Meanwhile, among Indian firms, Hindustan Aeronautics (rank 44) leads the list, which remained India’s biggest arms producer with arms revenues of $3.8 billion.

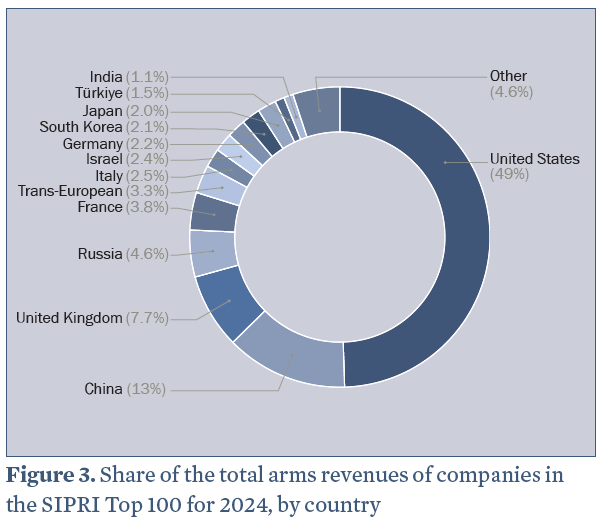

India’s Share in Total Arms Revenue is Minimal at just 1.1%

Bharat Electronics (rank 58) recorded the largest increase in arms revenues among Indian companies listed in the Top 100, rising 24% to $2.5 billion. This growth was attributed to orders from the Indian government for electronic warfare systems and radars. The third company is Mazagon Dock (rank 91), which saw its arms revenue rise by 9.8% to $1.23 billion in 2024.

However, India’s share of total arms revenue is only 1.1%, leaving a significant gap and indicating that India’s defence spending will continue to grow for some time to come. This is especially true given the increasingly tense geopolitical situation along India’s borders. So, how are these companies placed right now? Let’s take a look…

#1 HAL: The fighter jet monopoly with revenue visibility till FY33

Hindustan Aeronautics is a fighter-plane powerhouse and a strategic company in the aerospace, defence, and space industries. The company’s business is divided into five complexes: Bangalore Complex (production, maintenance, and upgrade of aircraft), MiG Complex, Helicopter Complex, Accessories Complex, and Design Complex.

Although HAL also manufactures fighter jets now, it still gets 70% of revenue from the Repair and Overhaul of aircraft, helicopters, and engines. This segment provides HAL with recurring revenue. Another 7% comes from design and development activities and exports. The company is known for manufacturing the Tejas aircraft, the Helicopter, and the Sukhoi Fighter Plane.

Strong order book provides long-term growth visibility

As of 14 November 2025, HAL’s order book stood at ₹2.3 trillion. This order book is relatively strong, providing revenue visibility for over six years. HAL management also states that these orders are intended to keep manufacturing lines busy until FY33. HAL is expected to benefit the most from increased defence spending, the Make in India initiative, and technology tie-ups with Russia to manufacture fighter jets in India.

HAL has 97 LCA MK1A aircraft on order. Deliveries are expected to begin in FY28, and HAL expects good returns from these deliveries. This order has at least 64% indigenous content, providing a major boost to Make in India. The company expects to receive additional orders in the second half of FY26.

This includes Su-30 upgrade projects worth more than ₹600 billion, maintenance, repair, and overhaul orders (₹190-200 billion), and orders for the Do-228 aircraft worth about ₹20 billion. HAL expects indigenous platforms, like LCA Mk1A, Advanced Light Helicopter, Light Combat Helicopter Prachand, and HTT-40, to remain the main revenue source in the near future.

The company sees Medium Altitude Long Endurance UAVs as a key opportunity, with the programme estimated at around ₹300 billion. HAL plans to develop the platform in partnership with DRDO. Beyond these orders, HAL is also focusing on indigenous projects, including mission-critical systems and engine programs such as the HTFE-25 and HTSE-1200.

Capacity expansion with moderate revenue growth

To meet this demand, HAL is planning capital expenditures of about ₹150 billion to expand capacity over the next five years. The company estimates revenue growth of 10% in FY26 and 12% and 18% in the next two years. EBITDA (earnings before interest, taxes, depreciation, and amortization) is expected to be around 30%.

#2 BEL: 24% revenue jump driven by radar & electronic warfare

Bharat Electronics (BEL) primarily focuses on advanced electronics equipment, systems, and services for India’s defence sector. The company focuses on Radars, Missile systems, and Defence communication systems. Given that electronics sit at the core of every defence system, and that radars and drones are becoming a new-age defence strategy, BEL has found itself at the centre of this transition.

₹1,300 billion order book expected by FY27

The company is focused on self-reliance through indigenization, with 75% of its revenue in FY25 coming from indigenously developed products. BEL order book stood at ₹756 billion (as of 31 October 2025). Further, the company expects to receive order inflows of ₹570 billion in FY26, taking the order book to around ₹1,300 billion.

The order book provides revenue visibility of over 5 years, based on FY25 revenue of ₹237.7 billion. In terms of order inflow, BEL is expected to receive significant projects in FY26, including QRSAM orders, Shatrughat and Samaghat projects, NGC-related subsystems, ground-based mobile ELINT system, mountain radar and HAMMER.

It also expects to receive some orders worth around ₹45 billion for the next-generation corvette program in FY26, and another ₹100 billion (upper band) in FY27. BEL is also expected to receive a ₹25 billion order for avionics packages for 97 light combat aircraft from HAL. Over the long term, BEL expects to secure annual new orders worth ₹250-300 billion.

Project Kusha (Sudarshan Chakra) in development phase

Project Kusha/Sudarshan Chakra, an air defence program in which BEL is developing major subsystems (radar and control), is currently in the prototype development stage. This prototype development is expected to take another one more year, followed by system integration and integrated trials. The first production order for Kusha is anticipated for December 2029.

Entering into advanced medium combat aircraft

BEL aims to increase its involvement beyond supplying electronic modules to encompass system integration, aircraft integration, testing, and validation, moving up the value chain. For that, Larsen & Toubro and BEL have submitted a Request for Information (RFI) for the Advanced Medium Combat Aircraft. The RFI evaluation is expected to conclude by Q4 FY26.

Expanding beyond defence to diversify revenue

Beyond defence, BEL plans to scale its non-defence business to about 20% of total turnover in the coming year, a sharp rise from 5.7% in FY25. BEL also plans to increase export revenue to 10% of total turnover, up from 3-4% currently.

#3 Mazagon Dock: Building India’s naval backbone with a ₹1 trillion target

Mazagon Dock is the first government-owned shipyard and the only Indian company to build both destroyers and conventional submarines for the Indian Navy. Mazagon is heavily focused on the Make in India and Atmanirbhar Bharat themes.

Make-in-India shipbuilding pioneer

This can be seen in the increasing indigenous content in the company’s ships. The P17A Nilgiri-class frigates (under construction) have about 75% indigenous content, higher than 42% in the P15 Delhi-class destroyers. As of 30 September 2025, Mazagon’s order book stood at ₹274.2 billion, and is expected to grow to over ₹1 trillion by FY27.

Diversification into commercial projects

Mazagon aims to diversify its revenue mix with a good balance of offshore, commercial, and defence projects to reduce its dependence on the Indian Navy. To this end, it is developing a mega shipbuilding cluster in Tuticorin, which will act as a large, dual-use shipyard for both commercial and naval use.

The plan is to build Very Large Crude Carriers (VLCCs) capable of carrying up to 300,000 deadweight tons. The total investment for this massive shipyard is estimated to be between ₹150-180 billion. The first phase is estimated to cost about ₹50 billion and is planned for completion over the next four to five years.

Sri Lanka entry signals Mazagon’s push into commercial shipbuilding and repair

The company is targeting short-cycle commercial projects, including tenders from PSUs like the Shipping Corporation of India, ONGC, and Indian Oil. It has also acquired Colombo Dockyard to expand its commercial shipbuilding and ship repair capacity. It plans to increase the shipyard’s annual revenue by 50% to around ₹10 billion to ₹15 billion by next year.

Can strong order books sustain these elevated valuations?

Bharat Electronics and Hindustan Aeronautics deliver high return ratios, including Return on Capital Employed (RoCE) and Return on Equity (RoE), driven by consistent, strong profitability and execution. On the other hand, Mazagon Dock leads in both return ratios as its growth, both in revenue and profitability, has been faster than the industry.

Valuation Assessment (X)

| Company | P/E Ratio | 5-Year Median P/E | Industry Median P/E | RoCE (%) | RoE (%) |

| Bharat Electronics | 49.6 | 29.5 | 62.1 | 38.9 | 29.2 |

| Hindustan Aeronautics | 33.8 | 20.8 | 33.9 | 26.1 | |

| Mazagon Dock | 43.0 | 21.7 | 45.2 | 43.2 | 34.0 |

In terms of valuation, after a sharp rerating over the past three years, their valuations are at a premium to their historical five-year valuations. While BEL and HAL are trading at a discount to the industry, Mazagon is trading in line with the industry. Their order books and order pipelines are strong, and given their strong presence in the defence segment, all three are expected to continue to benefit as India modernizes its defense equipment.

Disclaimer

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data were not available have we used an alternate, widely used, and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, their employees (s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.