The media is usually busy with the big names and the bluechips that hog all the limelight. But while this is happening, some lesser-known stocks silently laugh their way to the bank with their superior capital efficiency.

Two such lesser-known small cap stocks that were recently listed, are slowly getting the attention of smart investors, thanks to their solid capital efficiency. These are stocks not only beating industry peers when it comes to making profits on the capital they use, but are also champions when it comes to keeping the business free of debt.

Let us dive into these two stocks to see if they are worthy of being added to the Watchlist 2026.

#1 Safe Enterprises: The retail boom play (96% ROCE)

Incorporated in 1976, Safe Enterprises Retail Fixtures Limited designs, manufactures, supplies, and installs shop fittings and retail fixtures, providing customized solutions across various retail segments such as fashion, electronics, and department stores.

With a market cap of Rs 1,398 cr, the company raised Rs 161 cr through the IPO and got listed recently in June 2025.

The company has a current ROCE (Return on Capital Employed) of 96%, while the industry median is just 13%. Simply put, for every Rs 100 the company uses as capital, it makes a profit of Rs 96 on it, while its peers in the same industry average just about 13%.

Add to this that the company is currently debt free, which gives it the freedom to use the profits for giving back to investors or for growth purposes, as it is not bogged down by hefty interest payments.

Let’s look at the financials to see if the company has what it takes to sustain all of this. We are looking at the stand-alone numbers for the company and not consolidated, so that we have a slightly longer period to look at.

The company’s sales have grown from Rs 39 cr in FY22 to Rs 126 cr in FY25, logging a compound growth rate of 48% in the last 3 years. And for H1FY26, sales of Rs 90 cr have already been recorded.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) grew from Rs 2 cr in FY22 to Rs 45 cr in FY25, recording a 182% CAGR. And for H1FY26, EBITDA was Rs 34 cr.

As for the net profits, the company has logged in a compound growth of 221% from Rs 1 cr in FY22 to Rs 33 cr in FY25. And for H1FY26, the profits recorded were Rs 27 cr.

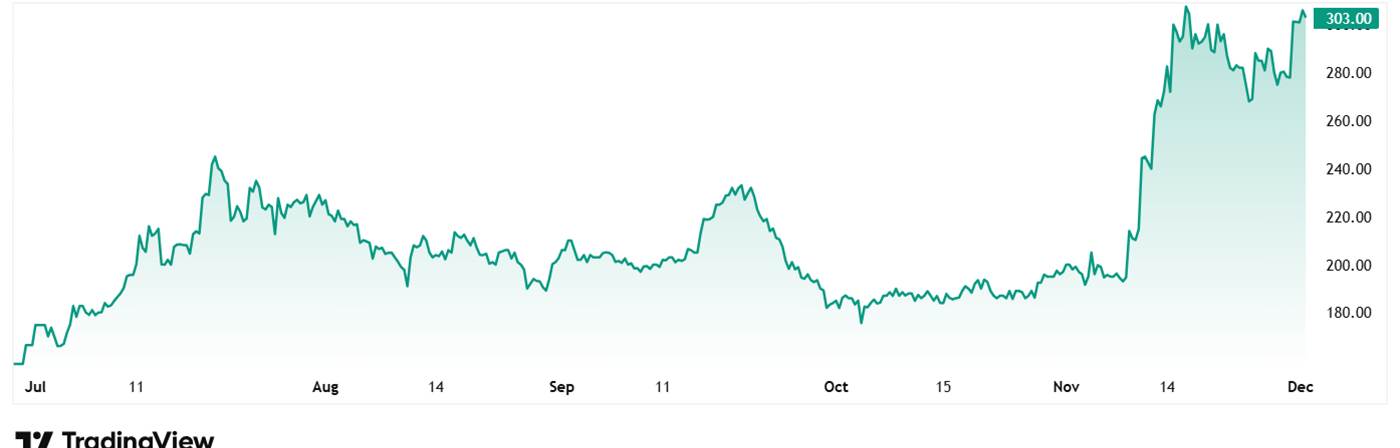

The share price of Safe Enterprises Retail Fixtures Limited was around Rs 158 at listing in June 2025, and as on 1st December it was Rs 300. That is a jump of 90% in a few months.

As for valuations, the company’s current PE is 25x, while the current industry median is 39x. The 10-year median PE for the industry is 41x.

In the recent investor presentation from November 2025, the Chairman & MD, Saleem Shabbir Merchant said, “As we look ahead to the second half of the year, our priorities remain clear — to drive sustainable growth, maintain financial prudence, and continue building long-term value for all stakeholders. On behalf of the Board, I extend my sincere appreciation to our shareholders, employees, customers, and partners for their continued support and confidence in the Company.”

#2 Influx Healthtech: The debt-free CDMO compounder

Incorporated in September 2020, Influx Healthtech Limited is a healthcare-focused company specialising in contract manufacturing.

With a market cap of Rs 535 cr, the company is a Contract Development and Manufacturing Organization (CDMO) dealing in nutraceuticals, cosmetics, ayurvedic/herbal products, veterinary feed supplements, and homecare products. The company’s core competency is end-to-end manufacturing services, that includes product formulation, development, regulatory support, and commercialization.

Influx has a current ROCE of an impressive 60%, while the industry median when compared to peers is just 15%. Plus, the company is also debt free, making it free to use profits effectively.

Looking at the financials, the company’s sales which were zero in FY21, jumped to Rs 105 cr in FY25. For H1FY26, the sales have been Rs 67 cr.

EBITDA, which was also zero in FY21, grew to Rs 21 cr in FY25, and for H1FY26 was Rs 15 cr.

The Net profits also jumped from Rs 0 in FY21 to Rs 13 cr in FY25. And for H1FY26, profits of Rs 10 cr were already recorded.

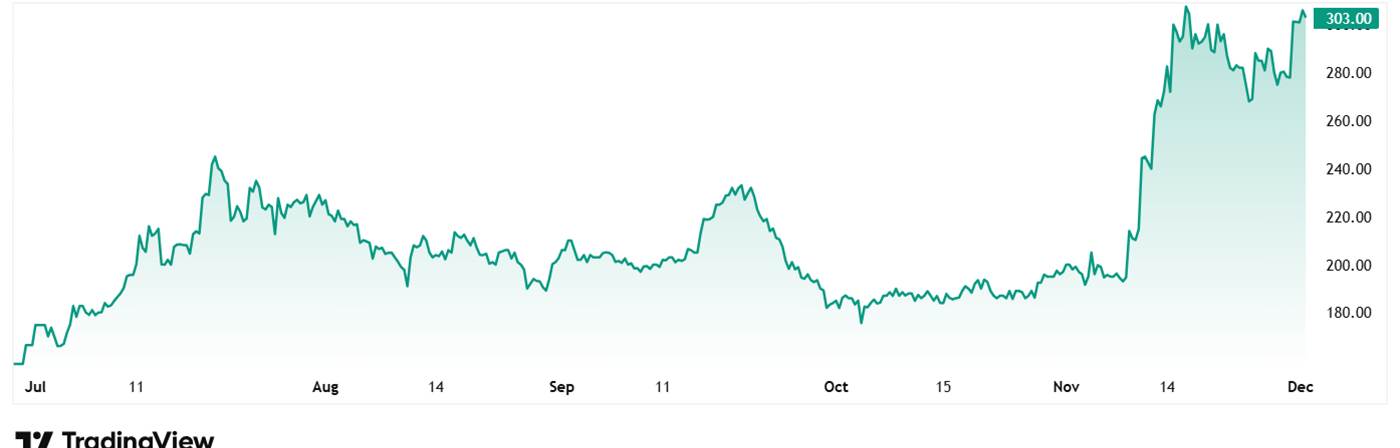

The share price of Influx Healthtech Limited was around Rs 126 at listing in June 2025, and as on 1st December 2025 it was Rs 231, which is an 83% jump.

As for valuations, the stock is trading at a PE of 30x, while the industry median is 32x. The 10-Year median PE for the industry is 27x.

As per the November 2025 investor presentation, In FY26, the company has a plan of around Rs 150 cr+ with H2 at Rs 80–82 cr with a current monthly run-rate of Rs 12 to 12.5 cr. The management’s medium-term objective is to double the business by FY27, with similar margins.

Smallcap surprises?

Both the stocks we saw today were recently listed and have shown some solid promise when it comes to managing money. With zero debt and high return on capital employed, the companies have proved they have systems in place to ensure enviable capital efficiency.

The financials as well look good for both as of now, and their respective managements as well seem to have drawn out a plan to possibly not only sustain it but also grow it. But it must be noted that both were recently listed, and it is still to be seen how the proceeds of the IPO are utilised.

While we can only know if these turn out to be smallcap surprises or something else, it makes sense to add them to a watchlist and follow them closely, so as to not be left behind if they do present a good opportunity.

Investor Caution: These stocks are listed on the SME exchange. Unlike regular stocks, SME stocks often require a minimum investment (Lot Size) of over ₹1 Lakh and carry higher liquidity risk, and other risks as well.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.