Share Market News Today | Sensex, Nifty, Share Prices Highlights: The benchmark equity indices ended Monday’s trading session in the negative territory. The NSE Nifty 50 plunged 218.85 points or 0.87% to settle at 24,795.75, while the BSE Sensex fell 638.46 points or 0.78% to 81,050. The broader indices ended in negative territory, with fall led by mind-cap and small-cap stocks. Bank Nifty index ended lower by 983.15 points or 1.91% to settle at 50,478.90. IT stocks outperformed among the other sectoral indices while Media and Banking shed.

The NSE Nifty 50 plunged 218.85 points or 0.87% to settle at 24,795.75, while the BSE Sensex fell 638.46 points or 0.78% to 81,050.

LTIMindtree emerged as the top gainer in the Nifty IT index, rising 2.22% during Monday's session. Other notable gainers included Persistent Systems up 1.62%, Mphasis gaining 1.50%, L&T Technology Services (LTTS) advancing 1.09%, and Coforge up 0.97%.

Power & Instrumentation (Gujarat) has announced the successful completion of a project for the Department of Atomic Energy, Nuclear Fuel Complex (NFC) in Kota, valued at Rs 10.18 crore. Following this announcement, the company's stock surged 4.97% on the NSE, reaching Rs 219.

At 3:05 PM, top gainers on the NSE included ITC up 1.58%, Bharti Airtel rising 1.43%, Bajaj Finance gaining 0.86%, followed by Cipla and Infosys with increases of 0.74% and 0.51%, respectively.

On the losing side, Adani Ports dropped 4.12%, followed by Coal India down 3.52%, NTPC falling 3.45%, ONGC down 3.34%, and Power Grid shedding 3.07%.

Prominent investor Ashish Kacholia has appeared in the Q2 shareholding disclosures of Jyoti Structures, holding a 2.52% stake in the company.

At 2:50 PM on Monday, the BSE saw a broad-based decline in market activity. Of the 4,042 stocks traded, 615 advanced while 3,300 declined, and 127 remained unchanged.

Despite the selloff, 151 stocks recorded new 52-week highs, while 114 touched 52-week lows. Additionally, 200 stocks were locked in the upper circuit, while 536 traded in the lower circuit. The overall sentiment remained negative as the market grappled with increased volatility.

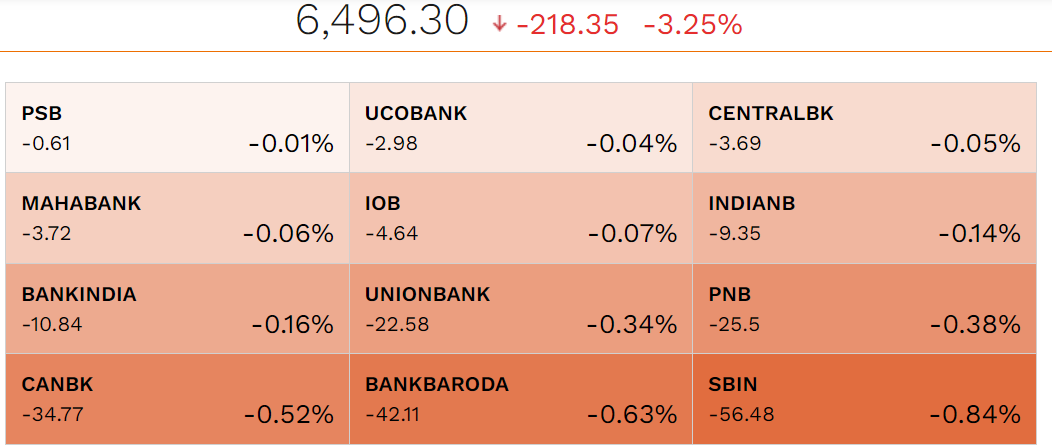

Several Nifty PSU Bank stocks experienced notable losses during Monday's trading session. Leading the declines were Indian Overseas Bank (IOB) down 3.83%, Union Bank of India falling 3.82%, UCO Bank losing 3.79%, Central Bank of India down 3.44%, and Punjab & Sind Bank (PSB) shedding 3.19%.

EaseMyTrip has expanded its franchising network by opening its first franchise store in Hyderabad, Telangana. Despite the business expansion, the company's stock traded 3% lower on the NSE at Rs 32.32 during Monday's session.

Over 75% of stocks in major indices, including Nifty 500, Nifty 50, and Nifty Bank, are trading below their 10-day SMAs. While FMCG, consumer durables, and metal stocks show resilience, financials have weakened. Despite Nifty 50 nearing its 200-day SMA, broader market indicators suggest the downtrend could persist.

Read More: Nifty struggles to hold 200 DMA; Can Consumer Durables & Metal lead recovery?

Rama Steel Tubes reported a robust sales volume of 50,921.67 tonnes in Q2FY25, up from 37,365.55 tonnes in Q1FY25 and 35,780.33 tonnes in Q2FY24, marking significant year-on-year growth. Despite the strong performance, the company's shares were down 3.15% on the NSE during trading.

Shares of Avantel surged 12% today after the company reported its earnings for the quarter ended September 2024. The stock jumped 12.66% to reach Rs 201 on the BSE, opening higher at Rs 198.90 against the previous close of Rs 178.40.

The company's market capitalization rose to Rs 4,590.50 crore. Avantel, a multibagger stock, has surged 843% over the past two years and 1301.26% in three years. With a beta of 1.1, the stock remains highly volatile.

Shares of midcap renewable energy firm Suzlon Energy hit the 5% lower circuit at Rs 70.98 during intra-day trading on Monday, marking the eighth consecutive session of decline. The stock has plunged over 15% since September 25, 2024.

The sharp drop in Suzlon's stock price follows an 'advisory cum warning' issued by the BSE and NSE earlier this month. The exchanges raised concerns about the company's corporate governance practices after the resignation of independent director Marc Desaedeleer. Both exchanges stressed that any future non-compliance with governance standards would be taken seriously.

"WTI crude oil prices surged past $75 per barrel before closing the week 9% higher at $74.38, marking the steepest weekly gain since late March 2023. This increase was driven by concerns that Israel might target Iranian oil rigs in retaliation for Iran's recent missile launches, raising fears of disruptions to oil supplies through the Strait of Hormuz. Prices are likely to remain volatile due to ongoing anxiety about a potential broader regional conflict, especially after statements from Iran's Supreme Leader Ayatollah Ali Khamenei calling for increased anti-Israel efforts. Today, WTI crude oil prices have edged slightly lower, trading near $74.20 amid concerns over potential Israeli retaliation, although U.S. President Joe Biden has advised Israel against targeting Iran's oil fields," said Kaynat Chainwala, Assistant Vice President of Commodity Research at Kotak Securities.

SBI, Bank of Baroda, Canara Bank, Punjab National Bank, and Union Bank were the major contributors to the fall of Nifty PSU Bank on October 07.

Courtesy: NSE

Shares of Adani Ports and Economic Zone fell 5.4% to an intra-day low of Rs 1,337. The stock was the major loser in the Nifty 50. The escalated conflict in West Asia is stressing the company's stock as it operates one of the largest ports, Haifa, in Israel.

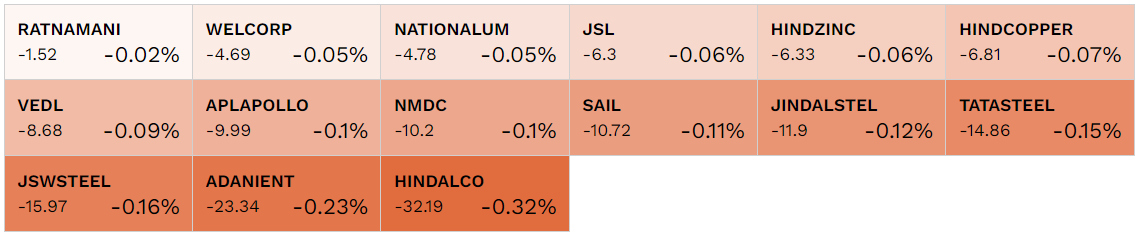

All the constituents of the NIty Metal index were trading in the red. Hindalco and Adani Enterprises are contributing most to the drag of Nifty Metal.

Courtesy: NSE

Indian Energy Exchange (IEX), the country’s leading electricity exchange, announced a substantial increase in its total monthly volume for September 2024, reporting a total of 11,370 million units (MU), which represents a remarkable 24% year-on-year (YoY) growth.

According to an exchange filing, the volume of electricity traded, which encompasses green electricity, reached 10,332 MU, marking a 21% YoY increase. Additionally, the trading of renewable energy certificates (REC) saw a significant rise, surging to 1,031 MU, effectively doubling the volume from the same period last year.

Shares of Reliance Power, led by Anil Ambani, fell by 11% from their 52-week high, hitting the lower circuit for the second straight session on Monday. The stock was locked at a 5% lower circuit at Rs 48.43, compared to the previous close of Rs 50.97 on the BSE.

As a result, the market capitalization of the firm has declined to Rs 19,454 crore. In total, 6.47 lakh shares changed hands during the session, resulting in a turnover of Rs 3.13 crore on the BSE.

Goa Carbon has announced the resumption of operations at its Bilaspur Unit, situated at 34-40, Sector B, Sirgitti Industrial Area in Bilaspur, Chhattisgarh. Despite this positive development, the stock is currently trading at Rs 746.35 on the NSE, down by 5.42%.

HVAX Technologies shares made their debut on the NSE SME on Monday, listing at ₹486, reflecting a 6% premium. The subscription period for the company's initial public offering (IPO) concluded on October 1, with the offering receiving a strong response from investors.

By the end of the subscription period, HVAX Technologies was oversubscribed 34.16 times overall. The breakdown of subscriptions revealed robust interest across various categories: the retail category saw subscriptions 26.69 times, the Qualified Institutional Buyers (QIB) category attracted 14.02 times, and the Non-Institutional Investors (NII) category was heavily oversubscribed at 77.92 times.

Domestic brokerage Emkay Global echoed this optimism, stating, “Titan has exceeded our growth expectations across most business segments.” Emkay highlighted the 26% YoY growth in jewellery sales during Q2, outperforming its estimate of 15%.

The brokerage noted that this strong performance would alleviate investor concerns about potential growth moderation and drive a 4-5% upward revision in earnings estimates. Emkay maintained a ‘buy’ rating, with a revised target price of Rs 4,400 per share.

Wockhardt has announced that its β-lactam enhancer-based MDR-active antibiotic, WCK 6777 (Ertapenem/Zidebactam), has successfully completed a Phase I study conducted by the Division of Microbiology and Infectious Diseases (DMID) at the National Institute of Allergy and Infectious Diseases (NIAID). Despite this positive development, the stock is trading at ₹918.85 on the NSE, reflecting a decrease of 4.83%.

Commenting on the Technical outlook of Kunal Kamble, Sr. Technical Research Analyst at Bonanza., said that The Nifty Index has closed below its support level of 25350, indicating weakness. Over the last three days, long positions have been squared off by approximately 8.36%, signaling that market participants are not expecting an upward move in the index until it can surpass the 26130 level. On the options front, the highest open interest (OI) on the CE side is at 25600 CE, where a short buildup has formed. On the PE side, the highest OI is at 25000 PE, where fresh long buildup has occurred.

Kamble also said that this suggests that market participants expect the index to trade below 25000. The weekly Put-Call Ratio (PCR) stands at 0.65, nearing oversold territory, which could be a concern for put buyers and call sellers. From a technical perspective, the Nifty Index is currently trading near its 50 EMA, which is positioned at 25067. The index has respected this level for the past month, making the 50 EMA a key support. A close below this level could lead to further downside, with potential targets at 24600-24300.

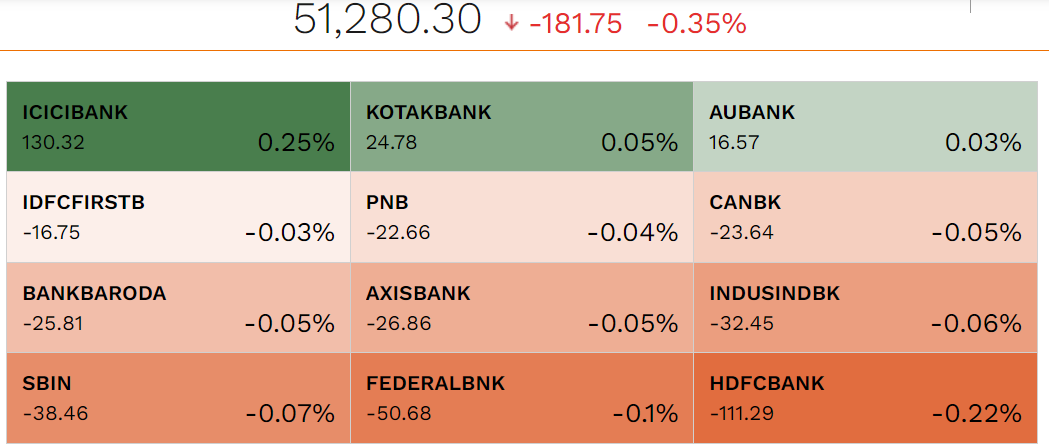

HDFC Bank, Federal Bank, SBI, IndusInd Bank, and Axis Bank saw major cuts in the banking index. They dragged the Nifty Bank on October 07.

Courtesy: NSE

Shares of Ola Electric Mobility continue to fall, the stock declined 8.9% to an intra-day low of Rs 90.26. The company is in the spotlight nowadays due to its service issues.

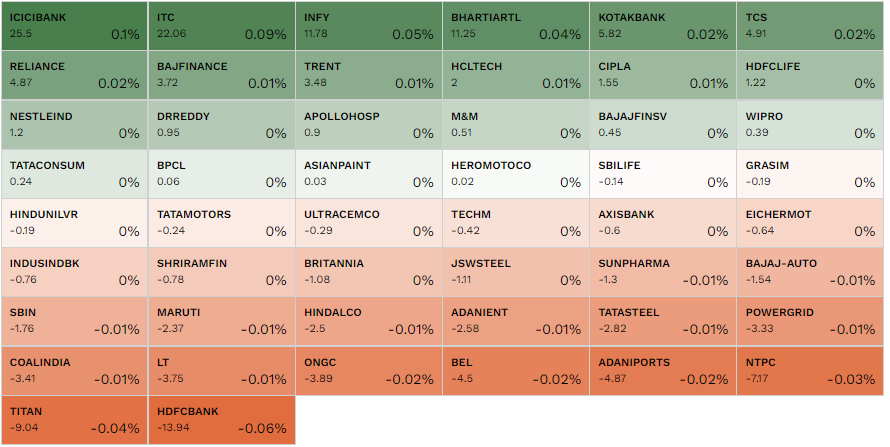

ICICI Bank, ITC, Infosys, Bharti Airtel, and Kotak Bank were the top five contributors to the Nifty 50 on October 07.

Courtesy: NSE

Shares of jewellery major Titan gained over 2% to touch an intra-day high of Rs 3,748 on the NSE after the company reported a 25% year-on-year (YoY) growth for the quarter ended September, as per its quarterly business update. The positive performance has led several brokerages to reiterate their optimism on the Tata group firm.