Info Edge’s Q2 revenue was in line as beat in 99acres and in-line performance by Naukri was offset by weakness in other businesses. Ebitda missed by 5% despite lower losses at 99acres due to weaker margin in Naukri and higher losses elsewhere. Strong billing growth implies positive near-term outlook. Multiple businesses including Zomato & Policybazaar are delivering on growth and we like the long-term story, but maintain Hold rating on expensive valuation.

Revenue in line, slight miss in Ebitda

Info Edge’s Q2 revenue was in line with estimate but Ebitda missed by 5% as lower losses in 99acres was more than offset by a dip in margin in Naukri, higher losses in Jeevansathi and `27 mn one-off CSR expenses. Higher other income, lower taxes led to in-line net profit. The company announced an interim dividend of Rs 2.5/share.

Naukri — in line growth, strong billing

Naukri revenue growth of 16% was largely in line with estimate of 15%, while billing growth accelerated to 26%. However, Ebitda margin dipped to 54% vs. 56.5% y-o-y and q-o-q.

99acres — strong performance

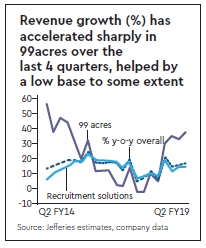

99acres revenue growth of 38% was higher than estimate of 30%.

50% billing growth suggests strong outlook at least in the near-term. Despite higher marketing spend, strong growth helped narrow losses q-o-q.

Zomato — strong growth

Zomato recently indicated 21 mn monthly order run-rate and an annualised GMV of $1 bn vs.3.5 mn orders and $210 mn GMV in January. However, we note that 86% of its orders are now being fulfilled in-house (through Runnr) vs. 26% in January and its reach has also expanded to 38 cities vs.

15 earlier, suggesting higher cash burn. It raised $210 mn from Alipay in a new round in October at an implied valuation of $1.8 bn pre-money vs. $1 bn in our SOTP. Accounting for decline in Info Edge’s stake from 31% to 28% and 20% holdco discount, the higher valuation adds `100/share to Info Edge.

Call takeaways

(i) Management reiterated its commitment to Jeevansathi and Shiksha despite continued losses in the two businesses. (ii) Investment philosophy for new opportunities continues to focus on early stage. (iii) Policybazaar continues to show good momentum and is entering health insurance.