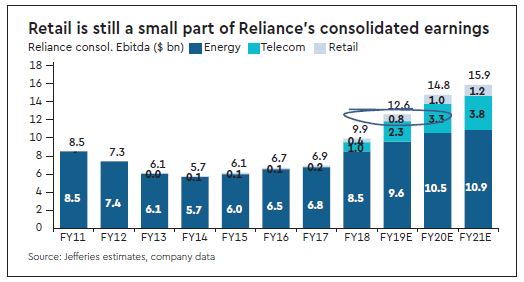

Well over a decade since it was launched, the salience of Retail has finally risen within Reliance’s investment thesis. Revenue growth may soon slow and margin expansion ease but the runway for organised retail is vast, boding well for India’s largest retailer. We now build uninterrupted growth for decades and infer a $19 bn EV to lift our PT to Rs 920. Peer comps suggest even more upside than what our prosaic DCF allows but we stay U/P noting potential EPS misses and rising liabilities.

Retail: Reliance’s success in mobile wireless has been the key tailwind for its shares but retail has also grown in salience with quarterly Ebitda trebling over the past year.

Macro: Growth may ease soon as might the pace of margin expansion but the macro runway is vast. Nominal GDP can rise in double digits for years keeping growth buoyant even if the share of personal consumption in GDP eases from 58%. Organised retail can grow even quicker, likely doubling in size to $150 bn in 4-5 years as it gains share from 10% now. As India’s largest retailer with 17.3msf of core retail space from 4,000 stores and a dominant presence in grocery, durables & fashion, Reliance is well poised to benefit. We build in this optimism, therefore, penciling 25/30% rev./Ebitda CAGR in the next decade.

Spend: Some of this will come from higher revenue per sf even if it is already near Walmart’s but most of it may need network expansion. Reliance spent $0.7 bn in FY18, e.g., with capex continuing likely lifting net liabilities (inc. JioPhone deposits) past $1.5 billion by Mar19e.

DCF: Indeed, annual capex may stay high, especially as refurbishment needs kick in but cashflow may rise quicker. Our multi-stage DCF (13.5% COE) suggests $19.3 bn in Mar20 EV (from $14 bn), therefore, implying 19.3x FY21e EV/Ebitda and 30x P/E for core retail.

PT: In turn, this also lifts the value of Reliance’s 94.4% stake to ~Rs 210/sh lifting our PT by 5% to Rs 920. In fact, retail has driven nearly all of the PT uplift since our 08, Dec17 initiation.

Peers: Indeed, retail (now 20% of our PT) punches above its 6% weight in Ebitda but with peers trading even higher than what our prosaic DCF implies, it may punch even harder. Anchoring to comps, e.g., would lift EV to $28 bn upping our PT by another 8%.

Risks: Yet, retail is not without its niggles. Disclosures are inconsistent, related party transactions (30% of opex) cloud the true picture and e-com & O2O, a source of much enthusiasm, may stutter as could valuations if risk aversion rises.

Rating: We stay Underperform, therefore, noting likely EPS misses, rising net liabilities as capex stays high and rich valuations (~22x FY18 P/E for 13%

FY18-23e CAGR).

Investment thesis/where we differ

We expect refining margins to ease from FY18e highs as refining demand-supply turns less benign than in 2017.

A fall in refining margins could weigh on earnings. Our standalone FY19-21e EPS estimates are ~8% below Street consensus.

Ebitda may still double to $20 bn by FY23e as new projects/telecom ramp up but FCF may lag Street forecasts.

Capex may halve from FY14-16 but could stay elevated; capex may be higher than the Street expects. E&P capex will pick up, telecom spend may continue for another 2-3 years while spectrum renewals may be a drag too in FY21.

In addition to vendor payments, core working capital could also normalise; this helped FCF by $10 bn in FY13-17. Net liabilities may fall more slowly than Street expects.

The telecom ramp-up may be bumpier than what the Street acknowledges. Competitive intensity and consumer behaviour may surprise negatively weighing on subscriber additions and ARPU. Tariffs are soft, e.g., and may remain so.

Even if all goes well, return ratios remain modest (RoCE: at 9.4% in FY23e, RoE at 13.3%) and net debt higher.

Valuations are rich too with ~12.0x FY19e EV/Ebitda — 30-35% higher than its past and 30-70% more than peers.