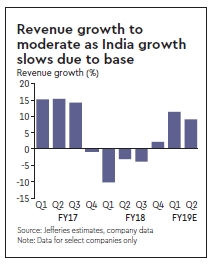

We expect Indian Pharma to report 9% y-o-y revenue growth and 100bps margin drop y-o-y led by slowdown in India growth (base effect) and muted US sales (flat y-o-y). We expect US business and overall margins to be flat q-o-q. We expect Dr Reddy’s Labs, Syngene, and NTCPH to report strongest earnings growth while Lupin sees the most decline. For Sun Pharma, specialty launch spend remains the key. Key to watch will be commentary on specialty launches and commentary on margins ahead.

Muted quarter

We expect Q2FY19 growth to be muted with revenue growth of 9% and margins down 100bps+ y-o-y and flat q-o-q. India business growth will moderate to 7% led by high Goods and Services Tax (GST) base.

Overall, we expect SUNP, LAURUS, SYNG and NTCPH to report double digit revenue growth.

US business to remain flat

We expect United States business to be flat q-o-q and y-o-y. We expect DRRD to report 8% decline led by lack of Suboxone sales. We expect SUNP sales to be marginally up (1%) as Taro decline offsets Ex Taro ramp-up and new launch benefits. LPC will see largely stable quarter. For STR we expect some sequential improvement.

Margins — not much gains

We expect margins to be largely flat q-o-q and down 100bps y-o-y despite INR depreciation led by muted US sales and GST stocking benefit in Q2FY18. We expect SUNP and DRRD to see q-o-q fall in margins. LPC and CIPLA will see some improvement led by operating leverage.

FDA approvals in Q2 flat

Approvals by USFDA remained largely stable for the overall industry (213 in Q2FY19 vs 208 in Q1FY19) and Indian companies. The filing rate, though, has increased substantially and is still ahead of approvals. Cipla (9) and Cadila (16) received the most approvals. SUNP positively got approval for Cquea and Xelpros but the significant benefits of Halol clearance are yet to be reflected in the approval.

US pricing, China pricing, specialty roll-outs the key

The key to watch in the results will be management commentaries on China pricing and key product approval. We will also look for commentary on pricing pressure in US and competitive intensity. SUNP/LPC — Specialty launches are the key while for DRRD/CIPLA/LPC — Key product approval will be the key.