Trends in the sector remain largely unchanged as a round of price hikes in key categories has landed in the market amidst stable underlying demand. Inflationary trends are still visible in select inputs while promotional intensity remains rational. Pace of innovations is robust. Given peaking margins and stretched valuations, we remain cautious on staples with select Buys. Prefer discretionary over staples.

Food RMs witnessing inflation

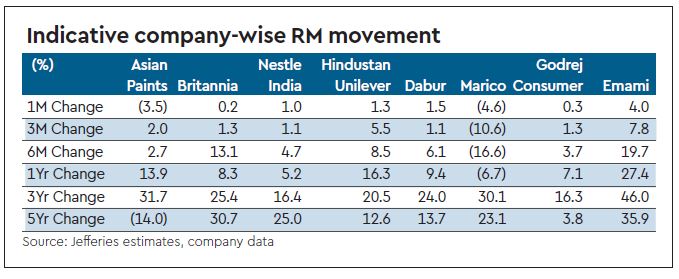

Though crude has seen a sharp correction in the last 1 month, crude linked RMs will take some time to reflect in terms of price correction. Overall Jefferies RM basket inched up 1% m-o-m largely led by mix of food and non food RMs. Within non crude, food based RMs, coffee saw sharp uptick of 14.5% m-o-m, Mentha rose by 7.2% m-o-m, barley increased by 6.1% m-o-m. Within crude linked RM basket, LLP rose sharply by 10% m-o-m, while crude corrected by 9% m-o-m during October month (corrected further in November). Palm oil sustained its corrective trend, down 3% m-o-m and 23% in last 1 year.

Also read: Best tax-saving FDs in November 2018: SBI Vs ICICI Vs HDFC Bank Vs Kotak Vs Axis; Interest rates compared

Taking a breather post a round of hikes

Fresh price hikes moderated as most of the price hikes taken in last quarter (especially in the HPC category) have landed in the marketplace. Given recent correction in crude and INR appreciation, current price hikes may suffice to maintain gross margins (though Q3 might see impact of high cost RM inventory).

Promotional intensity—stable

Promotional intensity in the market has seen some stability compared to the heightened scenario in the last 6 months. We saw some promotions in categories such as detergents, deodorants, body lotion, juices, soaps and toothpaste. However, we also saw some easing in promotions witnessed in the shampoo category.

Our view and top picks

Within the ‘superior execution’ bucket in staples, viz. HUVR, BRIT and GCPL, we find risk-reward less compelling given very rich valuations. Thus, we have Hold on all three names given no upside. Our preference is more for ‘potential turnaround’ set of companies on improving fundamentals going into FY19, i.e. ITC, Dabur and NEST where we have Buys. We still remain less convinced with risk-reward on Marico, Colgate, Emami and UNSP. Within discretionary space, APNT and JUBI are Buy rated while TTAN is a Hold on less compelling risk-reward.