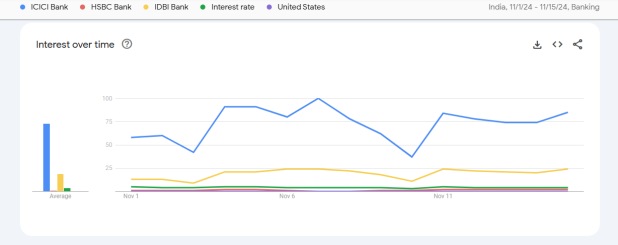

In November, there were five topics that were searched most on Google Trend, with reference to the banking sector. With Donald Trump emerging victorious, Fed’s rate action and commentary and inflation continuong to be a worry for India, interst rates was a popular and trending term. But that apart, data on Google Trends across Banking segment indicates that ICICI Bank is one of most trending search term followed by IDBI Bank. Here’s a list of topics that’s trending in November so far-

ICICI bank

ICICI Bank has updated its credit card terms, effective November 15, 2024. This marks the bank’s second policy update this year, impacting lounge access, reward caps, transaction fees, and charges for supplementary cards. The ICICI bank is the country’s 2nd largest bank and has a market capitalisation of Rs 8.6 lakh crore. It recetly announced its Q2 numbers and the bank has clocked Rs 11,746 cr net profit in Q2FY25, up 14.5% YoY. Its NIMs in Q2 is at 4.27%.

IDBI Bank

The centre has planned to off-load its stakes in IDBI bank after receiving a request for buying a stake in IDBI Bank through the Department of Investment and Public Asset Management. As part of the disinvestment plan, the Centre, in collaboration with the Life Insurance Corporation of India (LIC), will sell a 60.7 per cent stake in the bank. This includes a 45 per cent stake held by the Government and 49.24 per cent stake held by LIC. The process of privatizing the lender began in January 2023.

In its Q2 FY2025 results, IDBI Bank reported a notable 39% year-on-year (Y-o-Y) increase in net profit, reaching Rs 1,836 crore for the quarter ending September 30, 2024. Additionally, the bank achieved a 45 per cent rise in operating profit, which surged to Rs 3,006 crore from Rs 2,072 crore in Q2 FY2024.

HSBC Bank

HSBC Holdings recently announced plans to combine some of its commercial and investment banking operations in a major overhaul under new CEO Georges Elhedery, which will see it cut costs while trying to improve returns. Also, the appointment of Pam Kaur as the Bank’s first female chief financial officer is inlcuded in the future plans.

Interest rate

The Interest rate can be seen in trend because of the recent US Federal Reserve rate cut of 25 base points being a second rate cut in the year on November 7, 2024. The first rate cut took place in september of 50 base points. However in India RBI still has not changed the repo rate in the recent Monetary Policy Committee meeting, and kept it static at 6.5 per cent.

United States

The United states can be seen in trend for the Banking segment because of the recent victory of Donald Trump in the US Presidential election. Donald Trump’s election victory had an immediate impact on U.S. economic and foreign policy, as evidenced by a 6 per cent surge in the Dollar Index on election day. Trump adminsitration is expected to raise tarrifs, and higher interest rates. This may cause Federal Reserve to reverse its decision in upcoming future.